Revenue Forecasting In Salesforce – Reconciliation

When we think of the accounting process of reconciliation, we typically are thinking of the reconciliation of the balance sheet accounts. After all, the working capital side of a business is closed out annually and the earnings or losses are swept into retained earnings. The FASB requirements and standard practices of reporting for organizations.

But back on the working capital side of business where operations take place (Sales and Expenses), there is a far more important reconciliation process that is imperative to the life blood (cash) of a business. This reconciliation centers around the most important account in the chart of accounts, revenue.

Yes, sales reconciliation is full of bends and twists. We read about it every day, organizations missing the mark on sales forecast. Do you ever wonder why this occurs?

At White Rock, we work in Salesforce.com every day and we serve our customers who use it for tracking customer activity, recording opportunities for leadership, and addressing the anticipated sales transactions in the organization. The revenue may be derived from services, products, or donations.

What we know about the system processes that we build is that there is a defined and predictable relationship between the data recorded in an opportunity’s stage of the sale and the forecast category. For example, an organization may have a five-stage sales process like this:

- Initiate

- Discovery

- Prove

- Propose

- Negotiate

These stages would be related to a forecast category setup maybe like this:

- Pipeline

- Best Case

- Commit

- Likely to Close

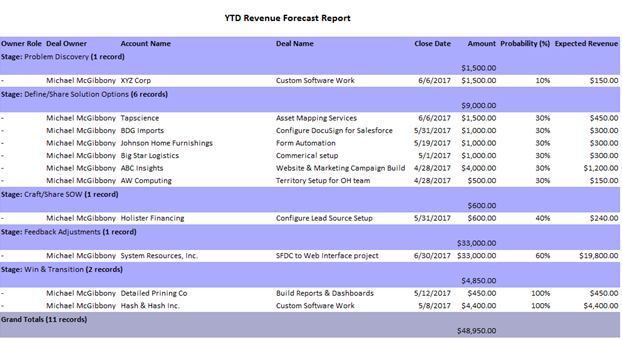

There is a percentage that is assigned to the stage to represent how likely that opportunity will be to get booked as a sale. These percentages are determined based on history and sales management’s sales process activity criteria. Here is an example of how this all comes together in Salesforce.com:

Stage Probability of Close Forecast Category

Initiate 10% Pipeline

Discover 20% Pipeline

Prove 50% Best Case

Propose 70% Best Case

Negotiate 90% Commit

In this example, if we have a deal that is in the Prove stage, then management has determined that 50% of the time, half the deals, will close when they reach this stage and they are categorized for Forecasting purposes as a best case. If the total value of those deals is $2,000,000 then experience says that $1,000,000 will result in booked sales.

Now the tricky part. What “moves” a deal along in these stages that provides the forecast outcomes? Well, sales activity on behalf of the sales team, of course. It is assumed that the activities are accurate and well-defined to result in a predictable probability of booked sales.

But what happens if a salesperson is “pushing” the input of data to better reflect a deal’s progress to help the in-process performance look better? Of course, then, we have a padded prediction. If management is not testing the sales activity inputs and puts an inherent trust in the values provided in the sales activity, then a risk is now set in a deal’s outcome. There is a mismatch now recorded in the deal tracking system between the buyer’s view and the seller’s view. Here is where the reconciliation of forecasted revenue breaks down.

This is where organizations should focus their reliance on the type of sales activity that is required in a specific stage of a deal/opportunity. We see so many times where there is poorly defined or subjectively defined activity requirements that are not really supporting a buyer’s behavior. As a result, quarterly forecasts become overstated and unreliable or, even worse, dangerously reflecting the value of future cash flows.

We believe that proper processes and tools that can be associated with long cycle sales are the most important, tactical weapons against this risk. We work with several organizations that focus on this and, in fact, we have developed applications native in Salesforce.com to help leaders have reliable sales forecasting.

We recommend that these types of tools be leveraged to provide a more objective set of activities that are related to the buyer’s journey and behavior. Using them will thwart the subjective input of data that can skew the success of a deal. We invite you to learn more about how White Rock can help you ramp up and conquer the risk and dangers of over-stated progress of deals in your organization.

The proper reconciliation of revenue in an organization is so vital to a healthy predictable cash flow. The setup of the Opportunity object in Salesforce.com utilizing the standard fields Stage and Forecast Category are vital. If this is an area where you think your organization can improve, please give us a call.