Revenue Forecasting In Salesforce – Accuracy

The work related to a valid and accurate revenue forecast using the Opportunity Object in Salesforce is one of the most valuable components of the platform. Let us take a deep dive into the details.

If you are a Salesforce organization, you may have an approach to revenue forecasting that is unique to your organization. We use organization because there are revenue forecasting techniques for non-profits who need to forecast donor collections which are treated like revenue. So, from the standpoint of the mechanics of Salesforce, these transactions have similar characteristics.

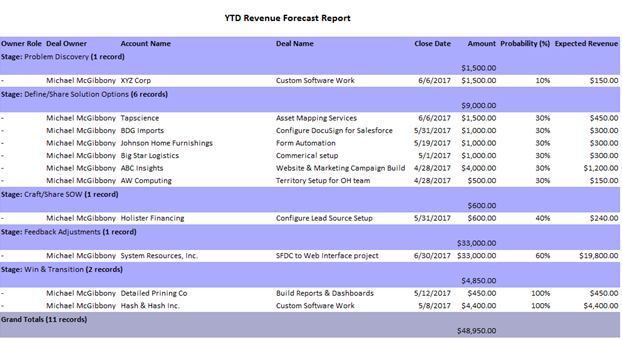

In last week’s article, I shared the reconciliation of a revenue forecast. I highlighted, at a high level, the standard components that are used in determining the accuracy of the forecast. Now, let’s take this a step further.

Let us start with the workflow of an opportunity. In Salesforce, the Account, or customer, is where the recordkeeping begins. The Account contains the many attributes of your customer like address, how you may have sourced the customer, the status of the customer, and so on. In addition, there are the key contacts to the account; those individuals that you work with and their specific information like contact information, social media information, and recorded historical activities and meetings that have taken place with your contacts. In addition, you may have your accounting information such as sales that report into your Account from another system to have sales, product, and service information related to this customer thus giving you a full picture of your account.

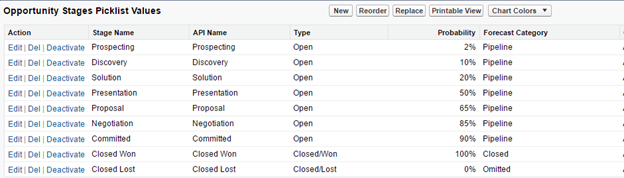

Now, we need to understand where the next revenue will be coming from. Typically, in Salesforce, the object called Opportunities is used. Opportunities are related in the database to the Account and the Contact. Opportunities are organized by stages of the progress towards a sale by using the standard field called Stage. The Stage field is designed around your typical deal progress from the beginning where awareness of the deal is learned all the way to the day that the contract is inked. The Stage field comes with pre-loaded values or you can customize these values with you own stages. Here is a typical layout of an Opportunities Stages:

As you can see, these stage values are listed in the order of the deal progress. There is the stage name, an API name to be used in the software language to reference, the Type, the Probability, and the Forecast Type. Each of these columns show the values in the fields related to the stage. In this example, if there is a single opportunity that is in the Prospecting stage, management has agreed that there is a 2% probability that the deal will close. In other words, 2% of all deals that begin for this company in our example will result in a closed sale based on the sales history. This varies based on each business, of course, but the logic is based on history and the information that is gathered on the opportunity in this stage and compared to previously won and closed deals.

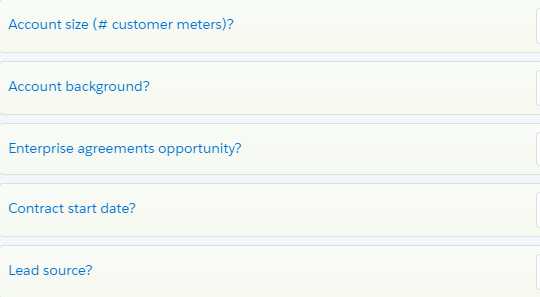

Let us look at the individual components that may be part of the Prospecting stage in our example. We use “two plays” in our Prospecting stage, Account Research and Initiate Contact. Each play has a set of parameters that must be learned (prospected). These parameters may look like this:

The answers to these questions are captured in the Opportunity record in these fields. When captured they are benchmarked against the historical answers for this specific stage to determine if they match historically and if so, then the probability of 2% will most likely be accurate since the values would be matched to opportunities that closed historically with the same or similar values. In this example, if Account size in number of meters typically has 100 or more meters for the opportunity to advance but the actual value captured is less than 100, then the probability that this deal has a 2% chance of advancing to a close is already off track and less than 2%. The same logic is used for each field in each play. The sales manager then can review the information in the Prospecting Stage to determine how well a specific deal is matching up to the historical values of past deals

When the opportunity is setup in Salesforce, there are two standard fields to help with the forecast of revenue, Amount and Expected Revenue. For an early stage opportunity, there may not be any value yet because it is too early to know the amount. If so, then Amount would show zero and the Expected Revenue the same. If, however, the product that they want has a price of $1,500 and they needed 2 items, then the Amount would show $3,000 and the Expected Revenue would show $60.

The affect is that for early stage forecasting, $60 dollars can be added to a period’s revenue forecast if the anticipated Contract start date is within the reporting period. In other words, if this deal begins on January 1 and has a projected contract start date of March 31, the revenue forecast will include $60 for this early stage deal based on the parameters captured in the plays of the Prospecting Stage.

This logic is used for each stage for each deal and the calculations roll down the same way through each set of “plays” per opportunity stage.

This is how we help customers design and organize their revenue forecast within Salesforce.